Selling your property can be a difficult decision. There are many factors to consider.

Check our our step by step process which will show you what to expect.

Once you have made a decision to sell your property and you need to engage a conveyancer to assist in preparation of the Section 32 and Contract of Sale which is given to prospective purchasers.

In order to give the most accurate information to a prospective purchaser you will be asked a series of questions with respect to the property in the form of an instructions spreadsheet. Please ensure you complete all questions to the best of your ability and if you are unsure about a particular question to ask your conveyancer.

Once your completed instructions have been received, your conveyancer will order the appropriate certificates to go with the Section 32. The appropriate suite of certificates should include, at the least, Council, Water and State Revenue Office.

When all the certificate have been returned the Contract and Section 32 will be prepared and a copy will be forwarded to the agent.

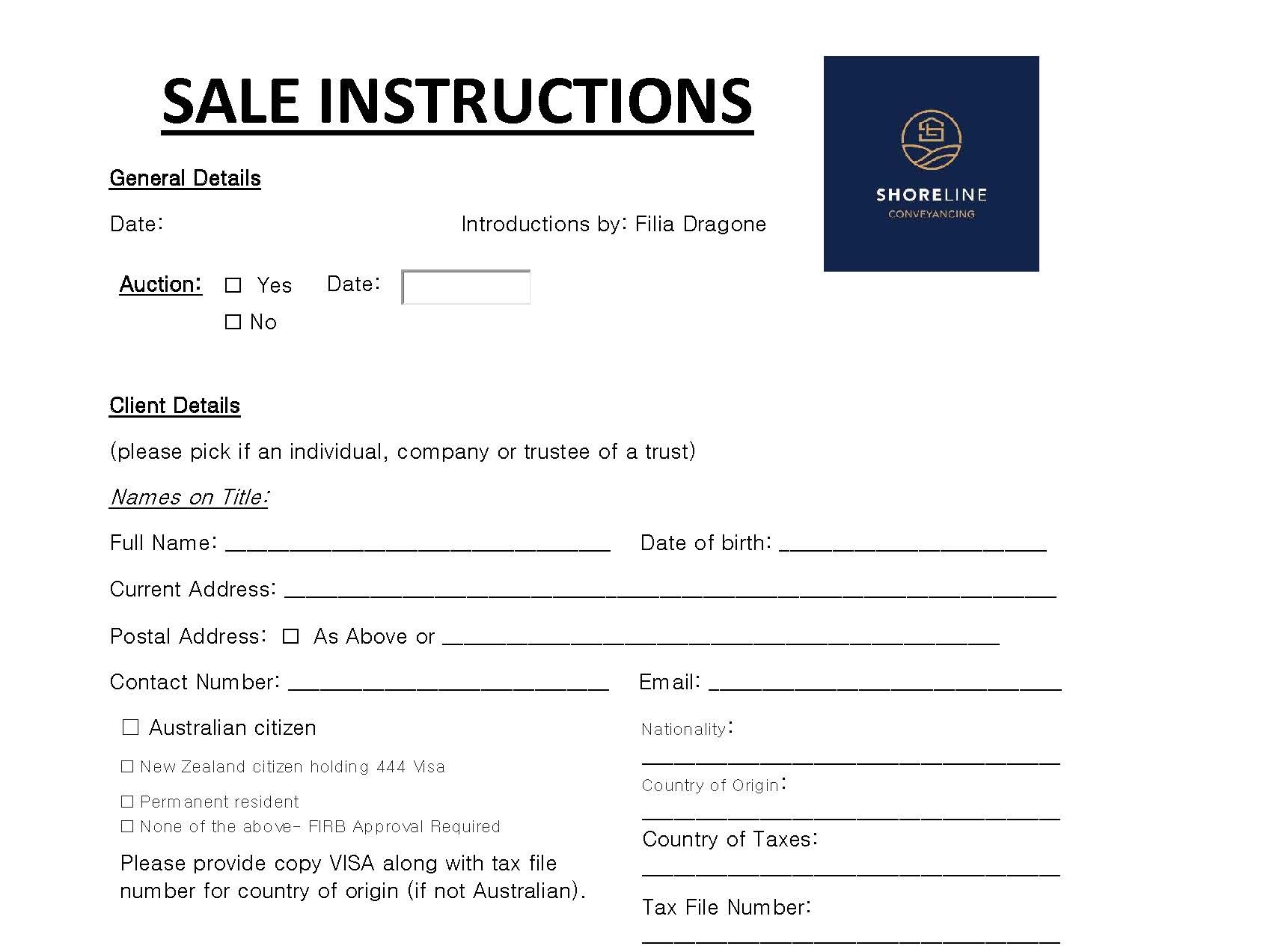

It is at this time, along with a copy of the Contract and Section 32, you will receive further documents to complete. These documents will be held on file in readiness of a Sale and subsequent settlement. Things can move very quickly hen a property sells and it is important to have these documents returned in a timely manner to ensure your conveyancer has everything they need to act quickly and efficiently when the property sells.

Congratulation’s, you have sold you property. At this stage it is imperative you advise your conveyancer that you have successfully signed a Contract. There will be key dates, information and actions which need to occur.

Your conveyancer will provide you with a letter reviewing the contract you have signed and confirming its contents. This letter will clarify your obligations to the Purchaser and vice versa leading up to settlement, for example; finance approval dates, building and pest inspections etc.

Once your Contract has become unconditional your conveyancer will arrange for your mortgagee to be notified and prepare to discharge the mortgage, or alternatively they will ask you to forward the certificate of title / authority to transfer the Electronic Control of the title to the office.

If you do have a bank involved in the transaction it is a great time to also touch base with them and discuss your requirements for discharging.

This will also be the time where you sign off on the State Revenue Office, Duties On Line (DOL) form. This online system now collaborates all the old forms used to notify the State Revenue Office of a sale transaction and is also used by the Purchasers to assist with the lodgement of their stamp duty. This DOL form is sent to you via an electronic email link and is signed online under the Electronic Submission Statements (Victoria) Act 2000. It is important you review and sign the document in a timely manner to allow time for the Purchaser to utilise the document for their requirements.

About 2 weeks before settlement your conveyancer will receive the Statement of Adjustments which will adjust the property outgoings.

Your conveyancer will review these according to the certificates provided by the Purchasers Representatives and send you a copy for your information and will seek that you confirm any outstanding amounts to be paid.

If you are unsure how the adjustments work please contact your conveyancer to discuss these.

It is also within this two week period your bank will most probably provide an indicative payout figure. This will allow for your conveyancer to give you approximate figures for settlement. It is a great time to double check all the figures given to you. even though they may not be final, they generally do not change very much.

Approximately 2 days before settlement, your mortgagee will update the payout figure as a final figure. Once this has been completed your conveyancer will update you with final figures for settlement and confirm banking information with you.

Settlement will proceed at the date and time which has been agreed by all parties and usually takes approximately 30 minutes to complete. This is completed on the electronic platform PEXA.

Once settlement is completed your conveyancer will inform you and allow the agent to release the keys to the Purchaser.

Your conveyancer will notify the relevant authorities, Council, Water and the like. You will also receive a final letter and documents to retain.

To book an appointment time to discuss what you need to sell your home please call our office on 0415 820 248 or click Enquire Now and a representative from our office will be contact with you.